Miners lead gains, oil jumps as war and rate hikes rattle nerves

Gains in banks, energy and mining stocks lifted Asian equities a little higher on Tuesday as investors braced for aggressive U.S. rate hikes and war disrupting oil supplies.

According to Reuters, Oil futures rose nearly 3% to a two-week high in Asia.

The yen fell through the key 120 level against the dollar for the first times since 2016 and Treasuries extended losses after U.S. Federal Reserve Chairman Jerome Powell on Monday flagged a more aggressive tightening of monetary policy than previously anticipated.

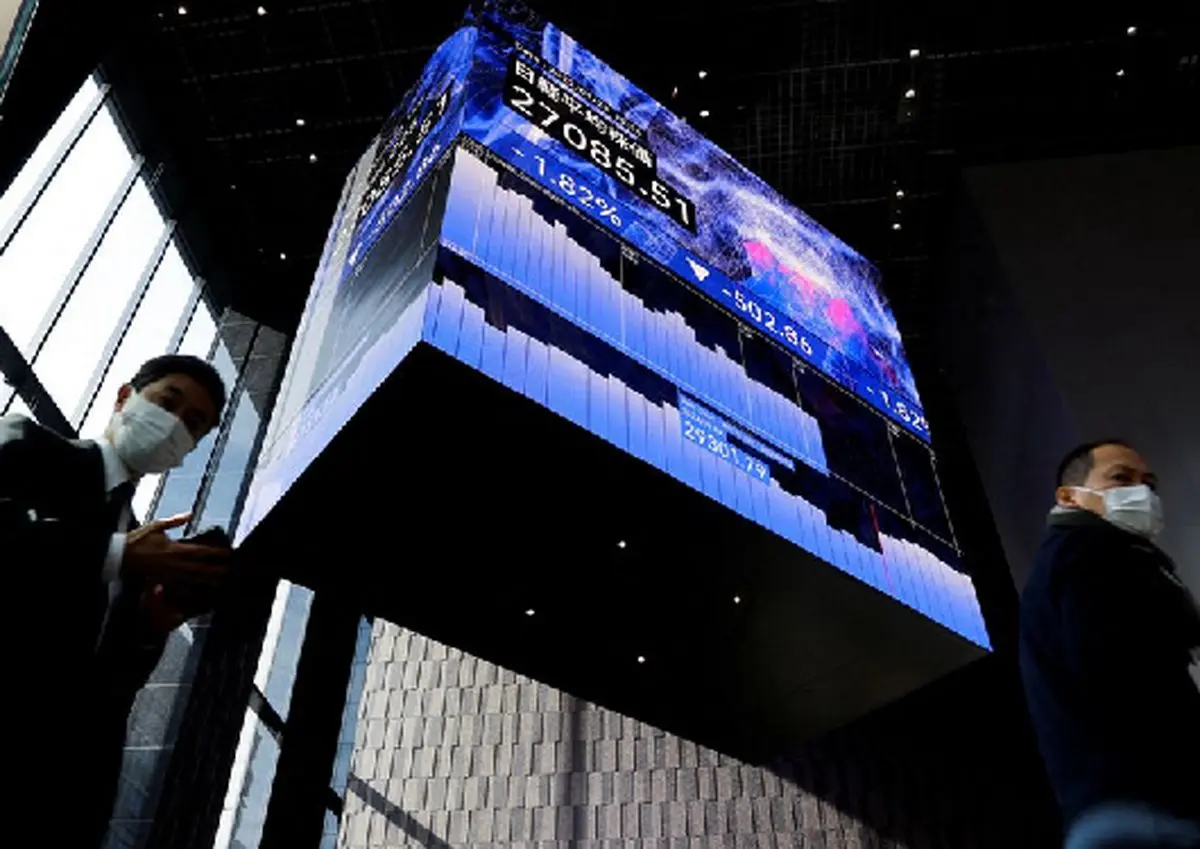

MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.1% led by gains in Australia's miner-and-bank heavy index (.AXJO), which hit a two-month high.

Japan's Nikkei (.N225) rose 1.5%. The benchmark advanced for a sixth straight session on Tuesday, heading for its best winning run since September, as energy shares got a boost from strong oil prices while financials gained on higher global bond yields.

In early European trade, the pan-region Euro Stoxx 50 futures fell 0.5% to 3,784. German DAX futures edged down 0.45% to 14,302 and FTSE futures lost 0.05% to 7,392.

"This very sharp spike in commodity prices is actually having relatively mixed impacts ... because we have some notable commodity exporters in this region, who would possibly stand to benefit," said Manishi Raychaudhuri, Asia-Pacific equity strategist at BNP Paribas.

Meanwhile, "investors are coming to terms with the fact that the developed markets' central banks would normalise monetary policy," he said.

Powell had sparked a bond rout overnight after he told the National Association for Business Economics the U.S. central bank was prepared to do what it takes to combat inflation and that bigger-than-usual hikes would be deployed if needed. read more

Treasuries and U.S. stock futures remained on edge, with S&P 500 futures down 0.3% and rates-sensitive Nasdaq 100 futures down 0.4%.

The benchmark 10-year Treasury yield was at 2.3333% by early afternoon in Hong Kong, which is close to the nearly three-year high of 2.3460% reached earlier in the day.

Fed funds futures are now pricing a two-third chance of a 50-basis-point rate hike in May.

The Japanese yen, also sensitive to rising U.S. rates, fell past 120-per-dollar briefly and last bought 120.4.

Chinese markets, on the other hand, are waiting policy easing after it was flagged by authorities last week.

China's blue chip index (.CSI300) slid 0.1% while Hong Kong's benchmark Hang Seng Index (.HSI) added 1.2%.

Onshore-listed shares of China Eastern Airlines (600115.SS) slumped 6.5% while those trading in Hong Kong tumbled 5.8%, after its Boeing 737-800 with 132 people on board crashed in mountains in southern China on Monday.

Tech stocks in Hong Kong (.HSTECH) extended a recent rebound, led by a 9% gain for Alibaba Group (9988.HK) after the company expanded a stock buyback.

Meanwhile, a lack of progress in the Russia-Ukraine peace negotiations continued to weigh on sentiment. Conflict raged on as Ukraine said on Monday it would not obey ultimatums from Russia after Moscow demanded it stop defending besieged Mariupol.

Oil futures extended gains on Tuesday morning on news that some European Union members were considering imposing sanctions on Russian oil and as attacks on Saudi oil facilities sent jitters through the market.

Brent crude rose 2.9% to $118.93 per barrel. U.S. crude ticked up 2.2% to $114.76 a barrel.

In other currency trade the euro was down 0.2% on the day at $1.0987, having lost 2.07% in a month, while the dollar index, which tracks the greenback against a basket of currencies of other major trading partners, was up at 98.778.

END